Mamra Almond 5A vs 4A: Which Grade Yields Higher Profit in the Indian Market?

In the complex and multi-layered ecosystem of the dry fruit trade with the Indian subcontinent, where centuries-old traditions intertwine with modern supply and demand mechanisms, precise Product Selection Strategy is the thin line between a mediocre trade and a business empire. For an Iranian exporter or a major importer in Mumbai, two legendary grades consistently top the order lists: Mamra Almond Grade 5A and Mamra Almond Grade 4A. Both are sub-categories of the strategic product, Mamra Almonds, which reigns as the undisputed king of nuts in the Indian market.

Many novice traders assume that profitability is summarized in the simple formula of "buy low, sell high." However, in specialized markets like the Mandis of Delhi (Khari Baoli) or Mumbai (APMC Market Vashi), hidden parameters determine the ultimate winner. This article moves beyond superficial definitions to dissect the technical, biochemical, logistical, and economic aspects of these two grades, providing a comprehensive roadmap to maximize your Return on Investment (ROI).

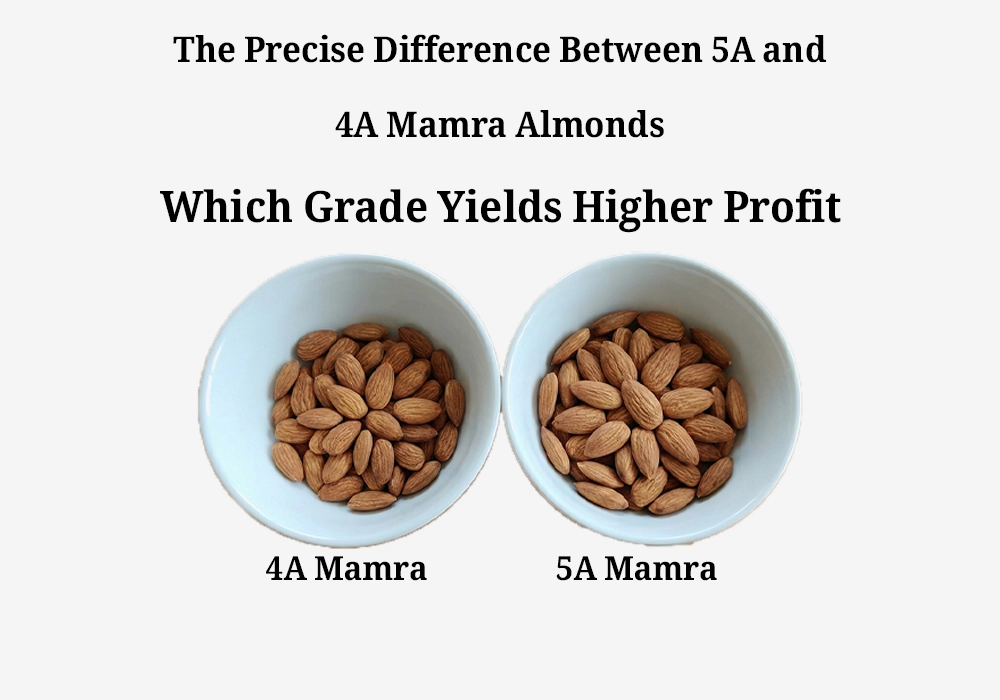

Chapter 1: Technical Morphology

Before analyzing financial profits, we must understand the common language of "quality" at a microscopic level. In India, Mamra Giri is not just a snack; it is a capital asset and a therapeutic good. Therefore, millimeter differences between 5A and 4A can shift the final container price by up to 20%.

1. The "Count" Conundrum per 100g

In international standards (USDA), California almonds are measured by "count per ounce" (28.35g). However, Iranian Mamra Almonds, due to their immense intrinsic value, are graded with higher precision on a "100-gram" scale. To better understand this product's position on the global stage and its fundamental differences from competitors, we suggest reading the Comprehensive analysis of the global almond market.

-

Grade Extra 5A (The King of Sizes): This grade boasts a count of 80 to 85 kernels per 100g. Each kernel weighs approximately 1.2 to 1.25 grams. This high weight indicates the full maturity of the almond embryo and maximum filling of the shell cavity before cracking. The large cross-section and beautiful curvature are symbols of Mamra authenticity.

-

Grade Super 4A (The Prince of the Market): This grade features a count of 90 to 95 kernels per 100g. The average weight per kernel is about 1.05 to 1.1 grams. While a difference of 10 kernels per 100g might seem negligible at first glance, in a 20-ton container, this difference translates to millions of additional kernels, significantly impacting the load's "Volume."

2. Uniformity and Surface Defect Analysis

The Indian buyer purchases with their eyes. A true 5A load must be "hand-picked" or "laser-sorted."

- Color and Spot Challenge: Due to its larger surface area, Mamra 5A displays any spots or shrinkage caused by dehydration more prominently. Therefore, the sorting process for Grade 5A is much more rigorous and costly than for 4A.

- Twin Kernels Challenge: In the Indian market, twin kernels (two kernels in one shell) are considered a quality defect because they lack the famous crescent shape of Mamra. In Grade 5A, the twin percentage must be absolutely below 2%, whereas in 4A, up to 4-5% is negligible.

Chapter 2: Organoleptic Profile & Biochemistry

Why is Iranian Mamra more expensive than Afghani Mamra or American almonds? The answer lies in Oil Chemistry. Indian traders might not have laboratories, but their tongues are the most precise quality assessment tools.

1. Fatty Acid Profile

- Grade 5A: Contains about 52% to 55% oil content. This is the highest possible limit among all almond varieties globally. The high density of Oleic Acid results in an extremely buttery, rich, and lingering taste. When you chew a 5A kernel, the oil release in the mouth is palpable.

- Grade 4A: Contains about 48% to 50% oil. Although still much richer than California almonds (35-40% fat), it has a crunchier texture compared to 5A, and the oil release is slightly delayed.

If your customer is looking for an almond with a thin skin but a white and sweet kernel, Iranian Moheb Almond can be a suitable alternative in a lower price range, but you must know it does not rival Mamra in terms of "nutrient density."

2. The Ayurvedic Perspective

In traditional Indian medicine, almonds are used to boost "Ojas" (vitality) and brain function. Traditional practitioners believe that the larger and oilier the kernel, the more "Prana" (vital energy) it holds. For this reason, for specific medicinal uses and child growth, larger grades are always prescribed.

Chapter 3: Market Psychology & Consumer Behavior

To choose correctly between 5A and 4A, you must know "who" will consume this almond at the end of the supply chain. The Indian market is not homogeneous; it is highly segmented.

1. The Gifting & Wedding Market -> The Realm of 5A

In Indian culture, especially during major festivals like Diwali and the Wedding Season, gifting dry fruits is a symbol of respect, wealth, and wishing good health.

- End Buyer: Large corporations (Corporate Gifting), 5-star hotel chains, and affluent Rajasthani and Gujarati families.

- Core Need: They want "Size" and "Prestige." Mamra 5A is placed in velvet boxes, inlaid wooden chests, or silver vessels. Here, price is a secondary priority. If you have genuine, uniform, and bright Mamra Almonds of this grade, you can demand astronomical Profit Margins.

2. The Health-Conscious Consumer -> The Realm of 4A

This segment includes the upper-middle class and premium dry fruit retail chains.

- End Buyer: Doctors, engineers, and mothers prioritizing family health.

- Core Need: They want the real properties of Mamra but are unwilling to pay for "Size Branding." Grade 4A is the Sweet Spot for this group. The taste quality is nearly identical, the therapeutic properties are the same, but the final price is more logical for monthly family consumption.

Chapter 4: Financial ROI Analysis

This is the most critical section for a trader. Let’s speak with mathematical logic and relative numbers.

Scenario A: Single-Product Export Strategy (Grade 5A)

- Sourcing Cost: Very High. Finding pure 5A loads that are precisely sorted is difficult and constitutes only about 10-15% of a garden's total harvest.

- Logistics Risk: Very High. Breakage is more likely in larger kernels.

- Inventory Days: Higher. Selling this grade in India takes time as it has a niche clientele, and the bargaining process is longer.

- Result: The profit margin per kilogram is Very High, but sales volume is lower. This grade is excellent for brand building.

Scenario B: High Volume Export Strategy (Grade 4A)

- Sourcing Cost: Moderate. This grade is more abundant in the orchards of the Zayandeh Rood margins.

- Turnover Velocity: Very High. In Indian wholesale markets, Grade 4A is like liquid cash. Demand for it is perpetual.

- Result: The profit margin per kilogram is Moderate, but due to high sales volume and rapid capital turnover, it generates a higher Annual Accumulated Profit.

Chapter 5: Risk Management & Quality Control (QA/QC)

Exporting Mamra almonds is not without challenges. Lack of precise product knowledge can lead to heavy losses (Claims).

1. Adulteration Risks

One of the biggest market problems is mixing lower grades with the main load. Some unreliable suppliers mix small grades with 4A loads. At first glance, it might not be obvious, but the Indian buyer will immediately notice using the "Count Test" (counting kernels in a fist or on a scale), destroying your credibility.

2. Freshness Detection & Oxidation

Old Crop is the biggest enemy of your trade. Due to high oil content, Mamra almonds oxidize quickly if stored in warm conditions, developing a rancid smell. To avoid falling into the trap of old stock, studying the technical article How to detect fresh vs stale almonds is vital. This technical knowledge transforms you from a simple broker into an expert.

3. Variety Substitution Errors

Sometimes traders are tempted to substitute other varieties due to lower prices. However, you must know that the target market is different.

- If your customer is an oil extraction factory or pharmaceutical industry, Shahroudi Almond 7 or Shahroudi Almond 12 are economic and practical options.

- But never try to sell Shahroudi or Rabie as Mamra for the dining table; their form and taste are completely different. To understand the structural differences of these varieties deeper, we recommend reviewing the article Difference between Rabie and Shahroudi Almonds.

Chapter 6: Proposed Portfolio Strategy 2026

Based on the above analysis and currency fluctuations, the Walmond strategy team suggests the following export portfolio:

- The 80/20 Rule (Pareto Principle): Focus 80% of your working capital on Grade 4A and Top 3A. These are the "Bread and Butter" of your trade and carry less risk. All these grades are available under the main Mamra Almonds category.

- Luxury Flagship: Allocate 20% of the load to Grade 5A. Even if its short-term profit is low, the presence of this load in your container adds credibility to the entire shipment and signals that you are a "Premium" supplier.

- Diversification: Always have alternative options. For customers looking for easy-to-crack shells, suggest Iranian Moheb Almond. For industrial clients wanting high volume and low price, Shahroudi Almond 12 is the best option to complete the container.

Final Conclusion: Which Grade is the Winner?

There is no short answer, but the winning formula is clear:

- If your goal is Maximum Profit per Kilogram and Luxury Branding -> Grade 5A is your choice.

- If your goal is Profit in Volume, Sales Velocity, and Lower Investment Risk -> Grade 4A is your smart choice.

The real winner in this market is the trader who can supply the right mix of these two based on their customer's needs in India. The Walmond supply team, with a precise understanding of these nuances and using advanced sorting machinery, guarantees that the shipped load strictly adheres to the standards mentioned in this technical datasheet. Don't forget, in the Indian market, "Trust" is the most expensive commodity, and consistent quality is the only way to preserve it.